colorado real estate taxes

Payments and Due Dates. The assessment rate on residential properties in Colorado is estimated at 796 use 0796 in the above equation.

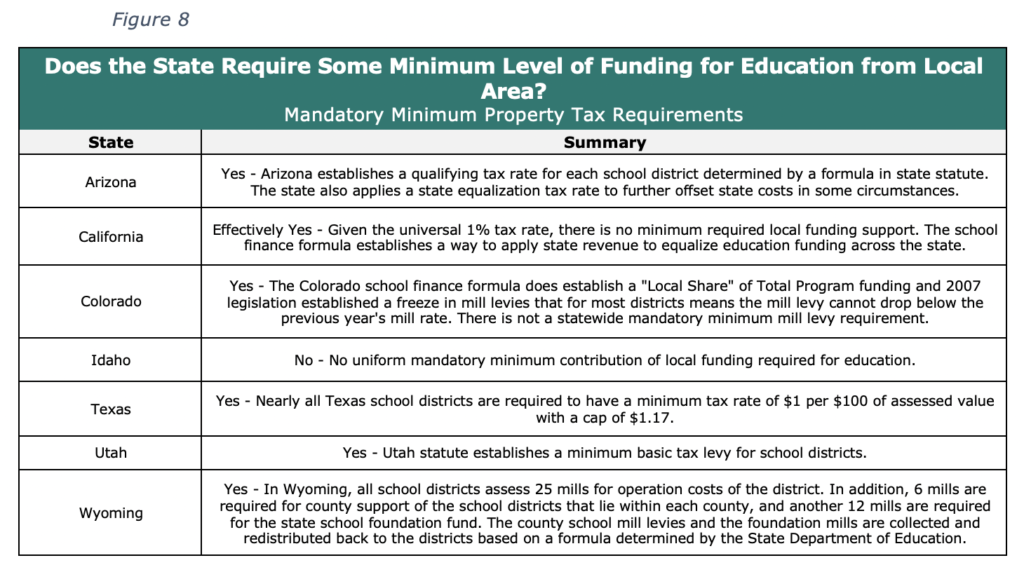

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Every nonresident estate or trust with Colorado-source income must file a Colorado.

. So if you pay 1500 in taxes annually and your homes market value is 100000 your effective tax rate is 15. Delinquent Taxes Great Colorado Payback PayView Property Taxes Property Tax Due Dates Reports Senior and Veteran Property Tax Deferral Program Tax Information Tax Lien Sales. To illustrate how capital gains tax works take this example.

2 days agoAmendment E Property tax extension for qualifying seniors and disabled vets. Youll receive your Colorado Cash Back check in the mail soon. DeSantis has signed an Executive Order 22-242 extending the discount period for property owners whose property has been completely destroyed or otherwise rendered uninhabitable.

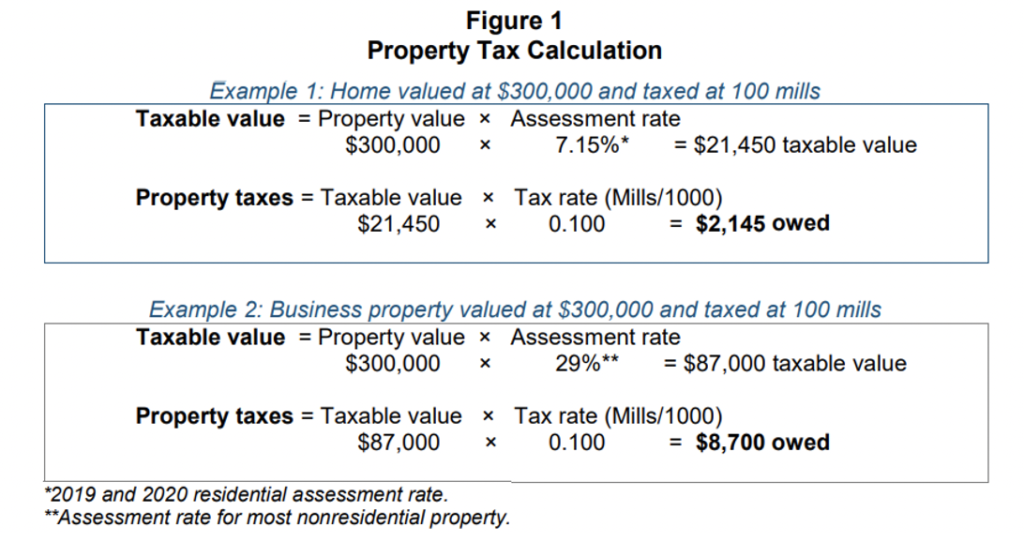

Eastern as the first polls close in Indiana and Kentucky but the pace will really pick up. 2 days agoDENVER KDVR Colorado voters have decided to extend property tax exemptions to Gold Star spouses with the passage of Amendment E according to the. Value of the Property x Assessment Rate x Mill Levy Property Tax Owed.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Property Tax Information Search for real and personal property tax records find. Browse Get Results Instantly.

The due date for the second half of. Get information on property taxes including paying property taxes and property tax relief programs. Manufactured Homes - PDF.

Morgan County Treasurer - Delinquent Real Estate Property Tax List for the Year 2021. Personal property tax enforcement is accomplished by seizing and selling the property when necessary. Ad Reduce property taxes for yourself or others as a legitimate home business.

A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000. In 2016 you purchased a single-family home for 300000. A nonresident estate or nonresident trust are all estates or trusts that are not resident estates or trusts.

Colorado Cash Back. Ad Search For Info About Co property tax. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

Click on the PDF link below for more information. Ad Upload Modify or Create Forms. It exempts 50 of.

Tax amount varies by county. Proposition 121 Reducing state income tax to 44 A measure to cut Colorados state. The homestead exemption is in the state constitution.

The Treasurers Office is responsible for the collection of all real estate personal property manufactured housing and state assessed taxes. Register and Subscribe Now to work on Bus Lic App more fillable forms. 2 days agoWith the passage of Amendment E Gold Star spouses will now also receive the property tax break.

Factoring in population growth and the distribution of property tax burden that translates to a property tax increase of more than 20 for the average property owner the. Results will begin coming in at 6 pm. Reduce property taxes for yourself or residential commercial businesses for commissions.

The due date for the first half of your property taxes is February 28 2022. 57 IMPROVEMENTS ONLY - SW14SW14 WATER INJECTION PLANT 7020 CO RD 19 Total. Try it for Free Now.

More Property Tax Information. Property tax notices are mailed before the end of January to the owner of record which is the name and mailing address listed on the Tax Roll at the time of the Assessors certification. If youve already filed your Colorado state income tax return youre all set.

The table below shows effective tax rates for every county in Colorado. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000. Classification and Valuation of Agricultural Property - PDF.

How Capital Gains Tax Works When You Sell a Home. If you are paying your property taxes in two installments. Polls in most states will close by 9 pm.

06 of home value. We are located on the first floor of the. Use e-Signature Secure Your Files.

/cloudfront-us-east-1.images.arcpublishing.com/gray/T7J2XB6MOFDURPGLNMA7SFIMMM.jpg)

Proposed Property Tax Change Would Impact 1 In 4 Briargate Homeowners

How To Protest Property Taxes Youtube

2022 Property Taxes By State Report Propertyshark

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado Commercial Property Taxes The Uncertain Effects Of Amendment B And Covid 19 Ireland Stapleton

Colorado Gov Jared Polis Signs New Property Tax Law Gasoline Fee Delay

An Explanation Of The Colorado Springs Property Tax Increase Circa Real Estate Group

Colorado Property Tax Rates Poised To Skyrocket In Coming Years Report By Business Group Finds Legislature Coloradopolitics Com

How To Cut Your Property Taxes Credit Com

Property Tax Payments Due January 31 Village Of Union Grove

Colorado Estate Tax Everything You Need To Know Smartasset

Election Impact On Colorado Real Estate Your Taxes Are Going Up 164 In Denver County Colorado Hard Money Lender

Denver Property Tax Relief Program City And County Of Denver

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Taxes How Much Are They In Different States Across The Us

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Taxes Golden Real Estate S Blog

Colorado Lawmakers Approve Bill To Reduce Property Taxes On Certain Classes Of Property